How Much do FinTech Companies Spend on Google Ads?

If you run marketing for a FinTech company, it’s helpful to know how much similar companies spend on Google Ads. Why? Maybe they know something you don’t!

- If you are spending more, are you wasting money on clicks by poor prospects?

- If you are spending less, have they found ways to be profitable that you are missing out on?

First, the data.

The Data – FinTech Google Ads Spend

The dollar values below are monthly Google Ads spending estimates along with recent trends as of September 2023. The first number is Google Ads spending within the U.S. For non-U.S. companies we also included their monthly spending in their home country.

[Caveat: This data was gathered using SpyFu, a leading PPC competitive analysis tool. These values are not precise — they are estimates based on ad exposure on the Google Search Results page. However, they should be in the right ballpark, and the comparative values are meaningful.]

Large FinTech Companies – Monthly Google Ads Spend:

These are some of the biggest players in 2023, each earning well upwards of $1B in annual revenue:

- Stripe (U.S.) – $350k, stable

- Checkout.com (U.K.) – $40k, declining [In the U.K.: $50k, declining]

- Revolut (U.K.) – $10k, stable [In the U.K.: $300k, stable]

- Chime (U.S.) – $800k, stable

- N26 (Germany) – $50k, currently paused [In Germany: $1M, stepped down to $300k for the summer]

- Wise (U.K.) – $130k, stable [In the U.K.: $240k, stable]

- Blockchain.com (U.S.) – $430k, currently paused

That is quite a range of ad spend for these large companies.

Particularly interesting is that Wise is spending 10x as much as its close rival, Revolut, in the U.S., while their spending is comparable in their home country (U.K.). Clearly, they have very different PPC strategies and/or have experienced very different results in the U.S. market.

It also appears that these companies, though global, still tend to spend more inside their home countries. Not a surprise.

But those large companies might not be a good benchmark for you. So let’s also look at…

Mid-Sized FinTech Companies – Monthly Google Ads Spend:

These financial technology companies are earning annual revenues between $100M and $1B:

- Onfido (U.K.) – $10k, stable [In the U.K.: $10k, stable]

- Plaid (U.S.) – $30k, stable

- Rapyd (Israel) – $15k, growing [data not available for Israel]

- Airwallex (Hong Kong) – $25k, stable [data not available for HongKong]

- Securitize (U.S.) – $5k, stable

- Uptake (U.S.) – $10k, stable

- Blend (U.S.) – $10k, declining

It’s interesting how narrow (and low) the ad spending is for this sampling of companies. But of course there are hundreds that could have made this list, so keep in mind that this is just a handful of data points.

Finally, how about…

Small FinTech Companies – Monthly Google Ads Spend:

These fintech companies are earning annual revenues under $100M:

- Kabbage (U.S.) – $1M, stable

- MoneyLion (U.S.) – $25k, stable

- Tally (U.S.) – $100k, stable

- Stash (U.S.) – $60k, stable

- Toro (U.S.) – $45k, stable

- Novo Financial (U.S.) – $200k, declining

- Brex (U.S.) – $140k, stable

Wow, these have a lot more variability and in some cases are spending much more than the “medium-sized” FinTech companies, likely due to a desire to grow quickly.

But it is important to also note that many small FinTech companies are not spending any money at all on Google Ads (we filtered out about 20 such companies to achieve this list of 7). In contrast, nearly every mid-sized and large FinTech company we checked is spending money on Google Ads.

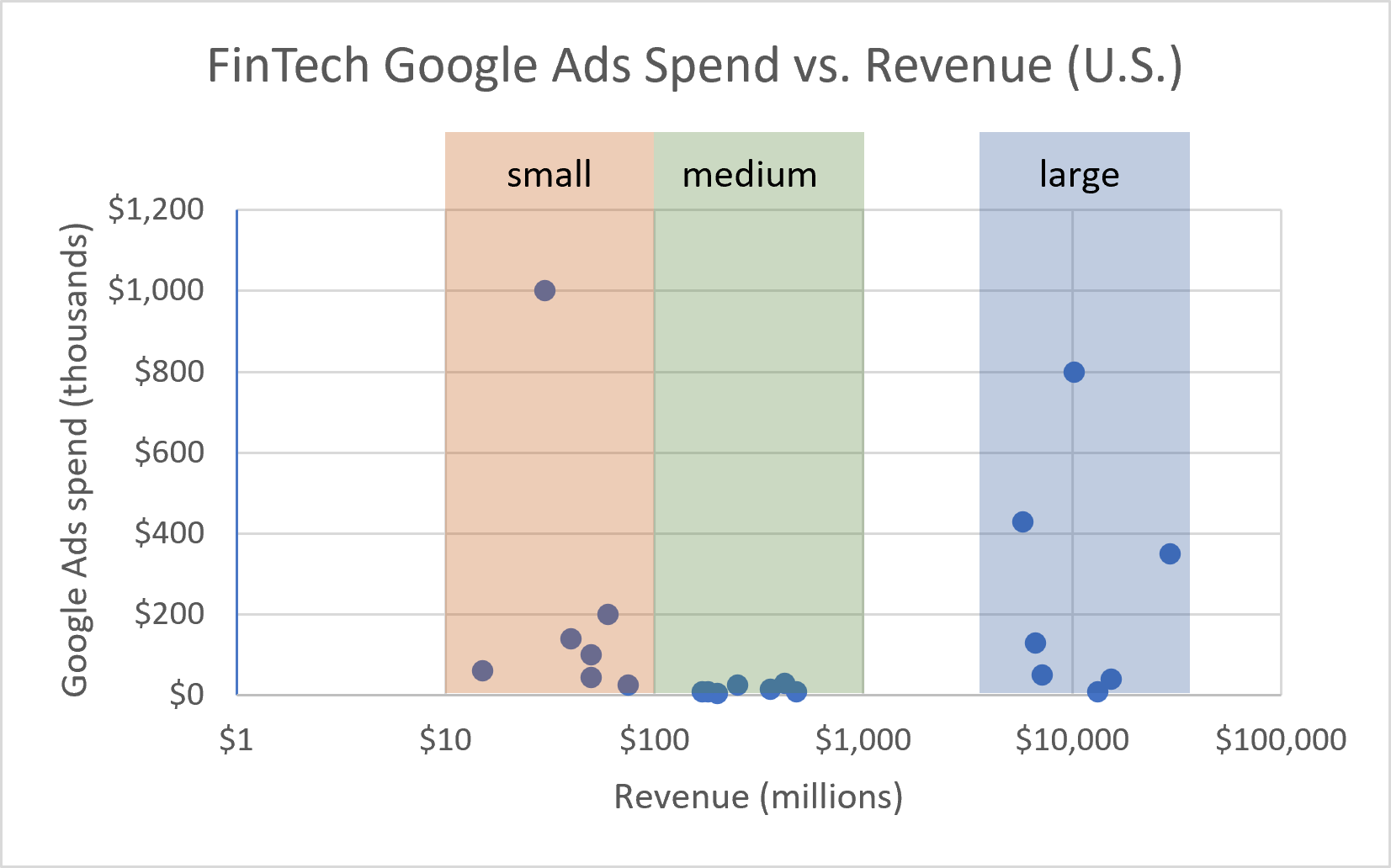

All together now:

So… What should you do about this?

Maybe nothing. But do some of these numbers surprise you, especially for companies related to your FinTech business? Then you might want to review your Google Ads campaigns and ask:

- Are we wasting money on campaigns that don’t generate enough revenue?

- Are we instead targeting too narrowly and missing out on significant revenue generation?

- Are we able to measure all of this accurately?

Do you need help to answer these ad spend questions?